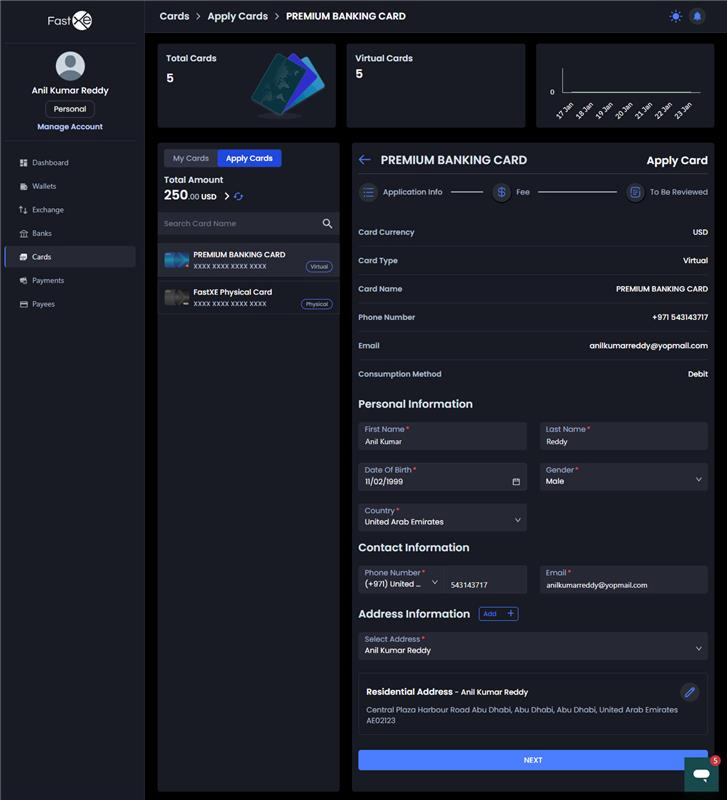

2. Virtual Card Application Process

The Virtual Card is applied for in the 'apply card' section.

2.1. Review Requirements and Charges:

-

Users must review the application rules and required information.

-

Review all card charges, including:

- Issuing fee.

- First recharge (minimum and maximum limits).

- Spend limit (per month).

- Card cancellation charge and maintenance charge (if applicable).

- Review time (time needed for card activation).

- Supported platform details.

2.2. Provide Personal Information:

- Provide the First Name, Last Name, and Middle Name (if any).

- Provide a Mail ID.

2.3. Select or Add Address:

- Select an available address (registered, mailing, or trading address) or add a new one.

2.4. Select Currency and Network:

- Select a stable currency (e.g., USDT), as stable currencies are supported by the card.

- Select the network (e.g., TRC20) where the balance is held.

2.5. Confirm Payment:

- Review the issuing fee, first recharge, and the total estimated amount required for payment.

2.6. Activation and Detail Access:

- The card will appear in the 'my card section' once applied.

- Card activation will take 10 minutes.

- After activation, the user gains access to the card numbers, CVP, and expiry date, along with the card holder name and card balance.